Table of Contents

Wondering how to finance your MS in the US as an international student? Here are some things to keep in mind when you shortlist programs and universities during the application process.

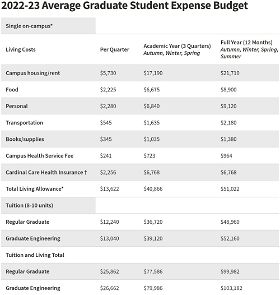

- Choose more affordable options - State universities often have lower tuition rates than private ones. The estimated cost of living listed on university websites (shown in the image) is somewhat inflated. You can save a ton of money if you have a frugal lifestyle. Consider avoiding expensive locations like the Bay Area.

- Compare funding opportunities - TA/RA positions provide stipends to cover living expenses along with a full or partial tuition fee waiver. The availability of these positions depends on the specific university and department. Don't count on a scholarship since they are hard to get. Some state universities may offer you a lower in-state tuition rate as part of a grant or scholarship.

- Employment as a student - You can work 20 hours/week on campus. The hourly rate usually isn't much, but better than nothing. Undergrad Tutor and Grader positions are also available. Summer internships are much more lucrative as you can work 40 hours and get paid a higher rate. It's not uncommon to get $7-8k per month in tech jobs.

- Employment after graduation - Paying back a loan is difficult without a decent job. Look at post-graduation outcomes for international students and check if employers are willing to sponsor graduates of the programs you shortlist. If not, don't bother applying. If yes, check for sign-on bonuses as these will help you pay back loans faster.

- STEM OPT - I'm oversimplifying things but basically, graduates can work up to a year on their F1 (student) visa. If you have a STEM degree, this can be extended for 2 additional years. If you enroll in a non-STEM program, you need to shift to another visa type after the first year of employment, most commonly H1-B. Since this is lottery based, plan for the worst case of not getting selected.

- Loans - It's hard to get a collateral free loan to cover the full cost of your program. At best, you'll get partial funding depending on the university and program. If you want to pursue an MS in CS, no problems, you'll be approved. If you want to pursue something which is not financially lucrative, too bad.

- Concluding thoughts - This is general advice, so please talk to current students and graduates of the programs you're targeting BEFORE you apply. Ask about the real cost of living, TA/RA options, internships, and employment opportunities. Don't get into a pickle where you have an admit but not enough funding.

If you find this insightful, please check out my previous posts on higher education - they are all on my "featured" section. Helpful links for TA/RA funding are in the comments.